New Insights on Oil & Gas Drilling Productivity in the U.S.

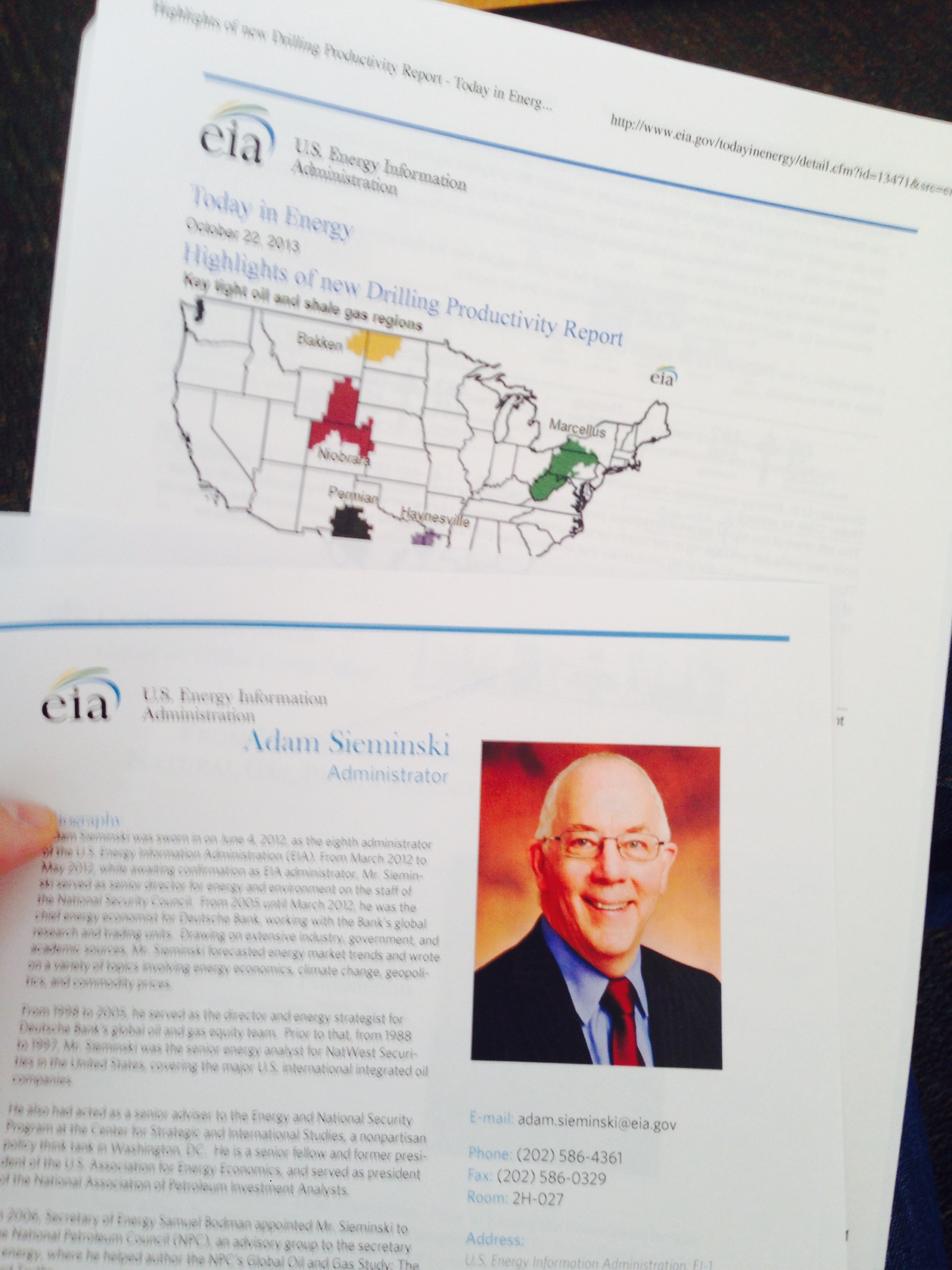

/EIA Administrator Adam Sieminski announced the newly published Drilling Productivity Report at Columbia University this week, and the key takeaway is that fewer wells have been needed to sustain production growth levels due to mechanical, technological, and operational efficiencies by drilling companies.

Image: Rigs needed to sustain production in the Eagle Ford play (Source: EIA Drilling Productivity Report presentation, 2013)

Other key insights presented include:

Considering new and existing wells separately helps to highlight plays where the growing number of relatively new wells leads to large monthly declines in legacy production, putting more pressure on increasing production from new wells in order to keep net output rising

In the six plays considered, steep legacy production decline rates offset new well production by 69% for oil and 73% for natural gas

Understanding the positive and negative forces that affect production volumes in a given region allows the estimation of the number of rigs required to make up for the natural loss of production from existing wells

Sieminski reports that it is not the number of wells, but the production per rig that has led the EIA to forecast a drop in future well development through 2040. He spoke of "multi-stage fracturing" as the precision technology strategically being implemented by drilling companies to optimize resources and reduce costs respective of inefficient extraction points.

Image: DPR methodology: step 1 – monthly additions from one rig (Source: EIA Drilling Productivity Report presentation, 2013)

When pressed about infrastructure necessary to scale out some of the more remote shale plays in the U.S., the Administrator spoke about extensive use of rail transport in the short-term while pipelines would be the delivery mode over the long-term. He added that all delivery methods incurred some kind of risk, and when pressed about a national energy policy that respects the environmental consequences, he alluded to an ideal policy framework that would encompass a nexus of environmental policy, national energy security, and economic growth.

Take a look at other highlights from the report here.